Not every patient knows that part of the money spent on dental treatment in our clinic can be returned to the tax office. Based on Art. 219 clause 1 clause 3 of the Tax Code of the Russian Federation, each taxpayer has the right to an annual social tax deduction for treatment, but not more than 120,000 rubles in the tax period.

Tax deduction restrictions do not apply to expensive types of treatment; compensation is made in the amount of actual expenses incurred.

The list of expensive types of treatment was approved by a decree of the Government of the Russian Federation. Implantation of dentures is included in the list of expensive medical services. Social tax deduction provided for in paragraphs. 3 p. 1 art. 219 of the Tax Code of the Russian Federation, allows taxpayers (patients) to reduce the tax base for personal income tax by the amounts they paid in the tax period for treatment services:

- in medical institutions of the Russian Federation;

- spouse;

- parents;

- children under 18 years of age.

What kind of treatment can I get a tax deduction for?

You can receive a tax deduction for any dental services if they were provided in a licensed clinic (Article 219 of the Tax Code). However, there are exceptions, for example, teeth whitening is not included in the list of services for which you can receive a deduction.

Compensation for dental prosthetics

Prosthetics are also included in the list of services for which you can receive a tax deduction. And considering that this is one of the most expensive manipulations, you can get the most attractive payments for prosthetics.

Who can receive a deduction?

Any person who had income in the year of providing dental services on which 13% personal income tax was paid can receive a tax deduction.

Saving percentage

Today, the maximum amount of compensation for installed braces is 120 thousand rubles. Of this amount, the obedient taxpayer gets the opportunity to return only 13%.

It is clear that a 13% reimbursement is an insignificant help during expensive orthodontic treatment, however, these funds will not be superfluous in the process of long-term correction.

It is important to know! The size of the payment depends on the amount of income tax (NDFL) paid by an individual within 12 months.

To accurately determine the amount of payment, experts recommend using the following formula:

SV = ZS * 13%, where SV is a social deduction, ZS is the amount spent (costs of medical services, purchase of a structure).

Let's find out together how to properly brush your teeth with braces, and whether additional devices are needed.

Come here if you are interested in reviews about whether it hurts to get braces.

At this address https://orto-info.ru/sistemyi-vyiravnivaniya-zubov/breketyi/skolko-stoyat-tsena.html we will calculate how much braces for children cost.

You can get a tax deduction even if you are not officially employed

You can receive a tax deduction for dental services not only for your own treatment, but also for services provided to parents, children, and spouse. Thus, even non-working pensioners, schoolchildren, students, people without official income can receive a tax deduction with the help of their relatives with a stable job. How to receive compensation for dental prosthetics for a pensioner? Through relatives who work with official registration. As a rule, one of the parents receives a tax deduction for dental treatment of a child.

What medical services are covered?

A social deduction for personal income tax for treatment can be obtained by:

- paid medical services. This may include paid tests, ultrasound and other types of diagnostics, medical procedures, dental treatment, etc.

For deduction, services can be provided to the individual himself, his spouse, parents, as well as children (including adopted children) and wards under the age of 18;

- paid for expensive treatment.

- paid prescription drugs, including for family members.

The amount of social deduction for treatment is provided in the amount of actual costs, but is limited to a total amount of 120,000 rubles for the tax period. In money it is 15,600 rubles. This limit does not include expensive treatment.

Tax refund for dental treatment: instructions

Documentation

Documents for tax deductions for dental treatment must be prepared in advance and submitted all at once. To receive a tax deduction for dental treatment, you need to provide:

- Passport.

- Certificate 2-NDFL and tax return 3-NDFL.

- Application for a deduction.

- Receipt(s) for payment for dental services.

- Agreement with the clinic that provided the services.

- ·Copy of the clinic license.

If you receive a tax deduction for your relative, you need to collect additional documents:

- Child's birth certificate (if the child was treated).

- Birth certificate of the person who will receive the deduction (if the parent was treated).

- Marriage certificate (if services were provided to the husband or wife).

Statement

The application is completed using a special form. It is better to request it from the Federal Tax Service so that you definitely have the correct document. You can look at examples and templates on the Internet, but we do not recommend downloading templates from unfamiliar sites; in this case, it is better to play it safe and once again check that you have the latest and most up-to-date form.

By the way, the tax office can help you fill out an application if you doubt that you can take into account all the nuances yourself.

News

November 9, 2018

Tax deduction for dental services.

Tax deduction for dental services.

The level of financial literacy in our country is not yet high enough. At the same time, citizens of the Russian Federation have a right, which I would like to talk about in more detail. Every person who receives an official salary and pays personal income tax can get part of their taxes back. But not everyone decides to do this, because they think that it is too difficult or impossible at all.

Everyone has had to go to dentists for some form of medical care. Dental services are quite expensive, but the state allows you to return part of the money spent in the form of a tax deduction under declaration 3 of personal income tax for dental treatment.

It should be noted that a tax deduction can be obtained when paying for dental treatment, including prosthetics, dental implants, installation of braces and other dental services in those clinics that have the appropriate licenses to carry out medical activities. If the medical institution where you had your teeth treated does not have a license, you will not be able to receive a tax deduction for the treatment.

In accordance with the Tax Code of the Russian Federation (subparagraph 3, paragraph 1, article 219 of the Tax Code of the Russian Federation), the amount of tax deduction depends on whether the treatment is expensive or not.

For expensive types of dental treatment, the amount of social tax deduction is accepted in the amount of actual expenses incurred.

For conventional treatment (medical services in dentistry) there is a limit on the amount of tax deduction - no more than 120,000 rubles. (i.e. you can return a maximum of 13% of 120,000 rubles - 15,600 rubles).

The specific tax refund amount is calculated in the 3rd personal income tax return.

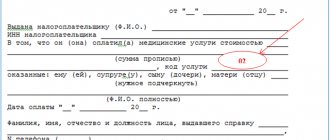

Along with the 3-NDFL declaration, a Certificate of payment for medical services is provided to the tax authorities in the form approved by Order of the Ministry of Health of Russia N 289, Ministry of Taxes of Russia N BG-3-04/256 dated July 25, 2001. You can obtain this certificate from the medical organization that provided you with the service. The original certificate is submitted to the Federal Tax Service.

The certificate of payment for medical services indicates which code the dental treatment belongs to - service code 1 or service code 2 in dentistry can be indicated.

There are two lists:

· list of expensive types of treatment (code 2) and

· list of medical services (service code 1),

allowing you to determine whether dental treatment is an expensive treatment.

The list of expensive treatment for 3 personal income taxes (dentistry and other medical services) and the list of medical services are approved by Decree of the Government of Russia of March 19, 2001 No. 201. Determining the service code in the certificate (whether dental treatment is expensive) is within the competence of the medical institution that provided medical services. The clinic employee, knowing that this relates to expensive dental treatment, fills out the “service code” column. If you do not agree with the choice of medical service code in the certificate, you must contact the clinic for clarification.

The answer to the question “Is my treatment an expensive treatment or not?” depends on which dental service or type of dental treatment was paid for.

Not every dental prosthetics is an expensive treatment. Thus, the operation of implanting dentures is included in the list of expensive treatments for 3 personal income taxes in dentistry (according to Letter of the Ministry of Health and Social Development of the Russian Federation dated November 7, 2006 No. 26949/MZ-14 and Letter dated November 8, 2011 No. 26-3/378332-2065). In this case, the certificate of payment for medical services will indicate code 2 (expensive dental treatment).

Other dental prosthetics (orthopedic dentistry) refers to conventional treatment - it is not included in the list of expensive treatments (code 1 for dental treatment). Here, the amount of tax deduction is limited to a limit (RUB 120,000).

Installing braces is not an expensive dental treatment. Although braces are quite expensive, the legislator did not include them in the list of expensive treatments for 3 personal income taxes. Therefore, the certificate of payment for medical services will contain code 1, not code 2.

An important addition, in accordance with the legislation (Tax Code of the Russian Federation, Article 219, paragraph 3), a taxpayer can receive a tax deduction for his own treatment, treatment of a spouse, dental services provided to his parents, dental treatment for a child under 18 years of age. In this case, the certificate of payment for medical services indicates as a patient a family member of the taxpayer who received ordinary or expensive dental treatment, and as a taxpayer - the one who will receive a tax deduction for dental treatment and file a 3rd personal income tax return.

To summarize, in order to apply for a tax deduction for treatment you will need the following documents:

Passport or equivalent document. Certified copies of the first pages of the passport (basic information + pages with registration) are submitted to the Federal Tax Service.

Certificate of income in form 2-NDFL. You can obtain such a certificate from your employer. The original 2-NDFL certificate is submitted to the Federal Tax Service.

Note: if you worked in several places during the year, you will need certificates from all employers.

Certificate of payment for medical services in the form approved by Order of the Ministry of Health of Russia N 289, Ministry of Taxes of Russia N BG-3-04/256 dated July 25, 2001. You can obtain this certificate from the medical organization that provided you with the service. The original certificate is submitted to the Federal Tax Service. Agreement with a medical institution for the provision of medical services. A certified copy of the agreement is submitted to the Federal Tax Service.

License of a medical institution to carry out medical activities. A certified copy of the license is submitted to the Federal Tax Service. Application for a tax refund with account details to which the tax office will transfer the money to you. The original application is submitted to the Federal Tax Service.

Tax return in form 3-NDFL The original declaration is submitted to the Federal Tax Service.

When applying for a tax deduction for children, a copy of the child’s birth certificate is additionally provided.

When applying for a tax deduction for a spouse, a copy of the marriage certificate is additionally provided.

When applying for a tax deduction for parents, you are additionally provided with a copy of your birth certificate.

It should be noted that in order to avoid delays and refusals, it is better to contact the tax service with the most complete package of documents.

If you can collect documents yourself, then specialists from the MFC “My Documents” at the address: Belgorod, Slavy Ave., 25 will help you fill out the 3-NDFL declaration correctly.

You can obtain more detailed information on the service of filling out the 3-NDFL declaration by calling contact-Belgorod region and 8 800 707-10-03.

Insurance policy

A deduction can also be obtained in cases where no medical procedures were performed, no medications were purchased, and the money was spent on paying for a voluntary health insurance policy. In this case, the deductible applicant will need a certified copy of the insurance policy or agreement with the insurance company.

A deduction will be possible only if the insurance contract provides for payment for treatment services, and the insurance organization has a license to carry out this type of activity.

A certified copy of the license is submitted to the inspection. Or a link to its details should be given in the contract.

The above documents must be accompanied by certified copies of payment documents indicating that the funds were spent on paying insurance premiums.

Is installing braces considered an expensive treatment?

This dental procedure does not fall into the category of expensive treatment. In a letter from the Federal Tax Service of Moscow dated August 19, 2010 No. 20-14/4/ [email protected] this issue was raised. The letter states that a refund for orthodontic treatment, including the use of braces, can be claimed taking into account a number of restrictions set out in the Tax Code of the Russian Federation (Article 219, paragraph 2).

The state will reimburse the taxpayer for the following expenses for medical services:

- Manufacturing and installation, removal of braces.

- Visiting the dentist.

- Cleaning the mouth, etc.

Important! The personal income tax refund amount will not include the costs of consumables for the braces system: springs, elastic bands, arches, since the procedure is not included in the list of expensive treatments.

When and where should you apply for a deduction for braces?

Only the tax service handles deductions for braces. A citizen must visit the territorial office of the Federal Tax Service by making an appointment in advance. Application periods are limited to three years. This means that a temporarily unemployed citizen who previously made contributions from wages to the tax office in the form of personal income tax can submit documents. As for the deadlines for submitting documents, the parent must submit them after the new year following the reporting year. For example, it will be possible to return part of the money for braces installed in 2022 from January 2019.

What conditions must be met?

To receive compensation payments, it is important to pay attention to the following conditions:

- The clinic that the patient has chosen to undergo orthodontic therapy must have an appropriate license to conduct medical activities and be registered in the Russian Federation (payments are not made for treatment in foreign institutions).

- A citizen who is planning to apply for a tax deduction must be officially employed or have any other income that is taxed at a personal income tax rate of 13% during the period when orthodontic treatment was carried out.

- No more than 3 years should pass from the moment the entire amount for braces was paid.

Expensive treatment: when is a personal income tax return declaration issued?

In some cases, there is a need for expensive treatment, and here you need to have a good idea of what documents are needed for 3-NDFL. The fact is that a tax deduction is allowed in such circumstances, and in an almost unlimited amount, but subject to certain conditions:

- firstly, the type of treatment must be included in the list approved by Decree of the Government of the Russian Federation dated March 19, 2001 No. 201 ();

- secondly, you should start filling out a return of income tax for treatment only after receiving a specific certificate issued by a medical institution (approved by order of the Ministry of Health of the Russian Federation No. 289).

When receiving a certificate, you should pay attention to the service code. For expensive treatment, the corresponding field should contain the number 2. When one appears there, the deduction will be limited to the usual limits of 120,000 rubles.

Certificate from a medical institution

When submitting documents to the tax office for a personal income tax refund for treatment, special attention should be paid to the certificate issued by the medical institution.

This paper will be needed if medical expenses have been paid.

IMPORTANT! The form of the certificate of payment for medical services was approved by order of the Ministry of Health and the Ministry of Taxes of Russia dated July 25, 2001 No. 289/BG-3-04/256.

At the same time, other documents confirming the fact of payment (receipts, checks, bills, etc.) are not needed, since this certificate is issued only if the services have already been paid for. This position is shared by both officials of the Ministry of Finance and tax authorities (letters of the Ministry of Finance of Russia dated March 29, 2018 No. 03-04-05/20083, dated April 17, 2012 No. 03-04-08/7-76, Federal Tax Service of Russia dated March 7, 2013 No. ED- 3-3/ [email protected] ).

See the material “Certificate or checks for treatment? The Ministry of Finance says - a certificate.”

Such a certificate can also be obtained after undergoing sanatorium-resort treatment. At the same time, it will not indicate the cost of the voucher, but only the price of treatment (less expenses for food, accommodation, etc.) and the amount of additionally paid medical services.

If you have the above certificate and the type of service provided is included in the list, to receive a deduction you will need 2 more documents from the medical institution that provided the service: a contract and a license. If the medical institution does not have a license to carry out medical activities or the treatment was carried out not by a Russian, but by a foreign clinic, the deduction will be denied.

Tax officials must provide a certified copy of the agreement with the medical institution. Particular attention should be paid to the terms of this document if expensive treatment was carried out, and you purchased materials or medical equipment at your own expense that were not available in this clinic. This will allow you to receive a full deduction.

The license is presented in the form of a certified copy. It is not necessary to attach a license separately if its details are specified in the contract.

Deduction for unemployed citizens

The most important condition for the implementation of the deduction is the payment of income tax. It is levied not only on wages, but also on other sources of income. These are:

- Funds from the rental of real estate.

- Income from the sale of movable or immovable property.

- Provision of civil law services.

If a non-working parent who has paid the 13% personal income tax required by law applies for reimbursement for a child’s braces, he can submit an application for a refund to the Federal Tax Service.

Are all costs included in this amount?

No, not all. A tax deduction is provided for diagnostic and therapeutic procedures and consumables, but its amount does not include the cost of orthodontic structures. Therefore, the clinic usually breaks the cost of treatment into separate components.

For example:

- Therapeutic dental treatment.

- Implant installation. The deductible amount includes: the initial doctor’s appointment and the taking of a diagnostic image, treatment planning and the operation to install it, repeat appointments, crown installation.

- Correction of bite with braces: diagnosis, installation of the system, techniques during treatment and activation, replacement of the arch, removal - are included in the deductible amount, but the cost of the system itself and its components is not.

- When treating with aligners, a deduction is also applied to the amount of the doctor’s work.

Compensation for children

You can return the deduction for orthodontic treatment of a child with braces if he has not reached the age of majority. This is evidenced by Art. 219 of the Tax Code of the Russian Federation, clause 3, clause 1 and letter of the Ministry of Finance No. 03-04-05/42144 dated June 20, 2018.

Based on this, it can be noted that an important condition for receiving compensation for a child is his age. The state of health and the duration of the educational process cannot affect the conditions established by law.

The law allows deductions to be issued not only for natural children, but also for adopted children and those under guardianship.

When concluding an agreement with the hospital where treatment will be carried out, it is important that the documents are issued in the name of one of the parents who has the right to receive a deduction.

A notarized copy of the son or daughter’s birth certificate must be attached to the main package of documented papers.

When submitting documents, the original must be with the applicant.

How to use orthodontic wax for braces and where is the best place to buy it.

In this post, we will discuss the price of lingual invisible braces.

Here https://orto-info.ru/ortodonticheskoe-lechenie/osnovnoy-period/brekety-i-karies.html we will tell you how to prevent the development of caries under braces.

Bottom line

Installing a braces system is not a cheap pleasure, so applying for and receiving a tax deduction based on the medical services received is an excellent opportunity to get back some of the money spent. If an adult is undergoing treatment, he applies to the Federal Tax Service or the employer with the appropriate package of documents independently. When it comes to correcting a child’s bite, all procedures related to compensation for payments are carried out by the parents (one or both at the same time). 13% of the cost of consumables will not be refunded; only medical services will be counted.

Important nuances of implementing deductions

To save time and effort on the annual collection of documents, it is better to submit all the papers at once for each year in which dental procedures were completed.

If the patient completes treatment and prepares the necessary documentation within the period of 3 years allotted by law, he will receive compensation. If braces were installed in 2022, you have until 2021.

If you undergo procedures at a clinic where the costs for braces components are paid separately, you will not be able to receive reimbursement for these costs. They will be deducted from the total amount of compensation.

Does everyone have the right

Residents of our country who regularly transfer income taxes in the prescribed amount to the state budget can count on compensation.

It is not necessary to make such payments on a monthly basis; the main thing is that the amount paid corresponds to the resident’s annual income in percentage terms regulated by the state.

In addition, the following persons can receive a deduction:

- having income and paying 13% tax on it;

- who paid for the services of a medical institution aimed at treating one of the family members (mother, father, spouse) or a minor child. Also, medications used during therapy, while the period for providing a refund of part of the financial costs is no more than 36 months.

Remarkable! A refund of part of the financial costs is possible if the citizen collects documentation confirming the fact of payment for orthodontic correction.

In accordance with the legal acts of the Russian Federation, the following categories of residents will not receive compensation:

- citizens who do not pay income tax to the country's budget;

- people of retirement age who had no income for 36 months before treatment;

- subjects of taxation making tax payments under UTII or “simplified taxation”.

As mentioned above, a citizen who pays personal income tax can receive compensation for braces.

Despite this, the procedure for calculating such a fee indicates that this type of taxation concerns not only official salaries, but also another source of profit.

Consider:

- funds received from the sale of a house, apartment, car;

- income from rental activities;

- profit received for providing legal services.

It is important to note! The listed types of earnings are subject to standard personal income tax.